Investing Opportunity: Perspective is Everything

Perspective is everything in life.

I see opportunity, do you?

While drafting this market update piece for most of Friday afternoon, the markets were in the deep red, with the Dow Jones Industrial Average (“DJIA” American index, where Apple, Microsoft, JP Morgan etc. are listed) being down nearly 800 points. When I checked the close, the DJIA rebounded dramatically on March 6, 2020 and was down just 256.50 points. Today the drop has continued as a new battle is emerging between Russia and Saudi Arabia over oil prices.

As I expressed during portfolio reviews over the past few months, the “fresh new market highs”, were not sustainable with the global markets rising consistently in late 2019 and early 2020. I was expecting a “10 percenter” or a correction and here it is. By definition, a market correction is a 10% price fall (but not farther than 20%) from the highest point.

Here is what some of the portfolio managers are thinking.

Manulife Investment Management:

“Broadly speaking, from a longer-term perspective, we still believe that the coronavirus outbreak could lead to buying opportunities. However, the events of the past two weeks have led us to think that the “dip” may be deeper and longer than most have initially expected, and we may still be some distance away from putting risk back on the table. In other words, the market has yet to find a bottom. However, further monetary easing from global central banks and the introduction of growth-friendly fiscal measures as a result of the outbreak could support a rebound in the second half of the year and we still believe equities will end the calendar year higher than where they are today.

Source: Manulife Investment Management: Coronavirus update: a material economic reassessment Feb. 26.2020

RBC Global Asset Management:

“The long-term return potential of the markets is quite stable, so when prices decline in the near-term, investors have an opportunity to add to their long-term return prospects. The companies we own in our funds have strong balance sheets and a history of navigating uncertain time. It’s been settling to have thoughtful conversations with management teams in recent days about risks and opportunities, as well as to hear what they’re doing to maintain healthy returns to shareholders.”

Source: Chief Economist Eric Lascelles, RBC Global Asset Management: Market Volatility Update Feb 28.2020

Monetary easing arrived on March 3, 2020 when Jerome Powell, Federal Reserve Chair trimmed rates by a quarter point in the United States. Our Bank of Canada Governor Stephen Poloz followed suit on March 4, 2020, with a large cut of fifty basis points.

Bank of Canada Press Release, March 4, 2020:

“Before the outbreak, the global economy was showing signs of stabilizing, as the Bank had projected in its January Monetary Policy Report (MPR). However, COVID-19 represents a significant health threat to people in a growing number of countries. In consequence, business activity in some regions has fallen sharply and supply chains have been disrupted. This has pulled down commodity prices and the Canadian dollar has depreciated. Global markets are reacting to the spread of the virus by repricing risk across a broad set of assets, making financial conditions less accommodative. It is likely that as the virus spreads, business and consumer confidence will deteriorate, further depressing activity.

It is becoming clear that the first quarter of 2020 will be weaker than the Bank had expected. The drop in Canada’s terms of trade, if sustained, will weigh on income growth. Meanwhile, business investment does not appear to be recovering as was expected following positive trade policy developments. In addition, rail line blockades, strikes by Ontario teachers, and winter storms in some regions are dampening economic activity in the first quarter.”

Source: https://www.bankofcanada.ca/2020/03/fad-press-release-2020-03-04/

One of my favourite Canadian economists is Frances Donald. She is the Chief Economist at Manulife Investment Management. She was interviewed by BNN Bloomberg in response to the rate cut and here is what she had to say:

“The goal is not to lift the stock market. That’s not the goal. The goal is to recognize what we witnessed in the past 2-3 weeks has economic implications. So do rate cuts help cure a health crisis? Absolutely not. Do they help cushion the economic impact? Yes. If you are a central banker, you have one tool, arguably a few smaller tools that do the same thing. Would you stand on the side lines when you know people are going to be afraid, suffering and pulling back? No you would use the tool that you have available in your pocket.”

Source: https://www.bnnbloomberg.ca/economics/video/we-are-living-through-history-manulife-s-donald-on-bank-of-canada-rate-cut~1914417

“Is this doom and gloom? No.

In fact, all I see is OPPORTUNITY.”

For those of you that have worked with me for a long time, you know that I like to be early to the party and early to leave. In 2018 and 2019, one strategy we implemented was to reduce exposure from pure equity funds and reduce risk by moving into balanced funds. In January / February 2020, many TFSA and RRSP contributions were allocated to cash as market prices were high. With market volatility now upon us, it would be prudent to consider starting to allocate that cash into a dollar cost averaging program.

How does a Dollar Cost Averaging program work? Simply put, you’re investing a fixed amount at regular intervals, regardless of market movement. When markets are volatile, you will pay less and purchase more units than you would have 6 - 8 months ago when markets were rising and prices were accelerating. The intention now is to take advantage of lower prices, but not all at once. Therefore, the strategy will deploy cash over the next 3 - 10 months as I believe that the markets are going to choppy for a while longer.

For those that are actively saving on a monthly basis, congratulations, you’re already taking advantage of a Dollar Cost Averaging program. Independent investment research firm Dalbar Inc. conducted a study back in 2007. Their study indicated that a Dollar Cost Averaging program produces returns over 20 years that were 40% higher than those experienced by the average investor. This is because the investor is buying into the dips as well as the highs.

Source: Quantitative Analysis of Investor Behavior, 2007, Dalbar, Inc. www.dalbar.com

Remember that investment performance is not to be measured in minutes or days, or even weeks and months. Rather, it’s years that offer you the best point of reflection.

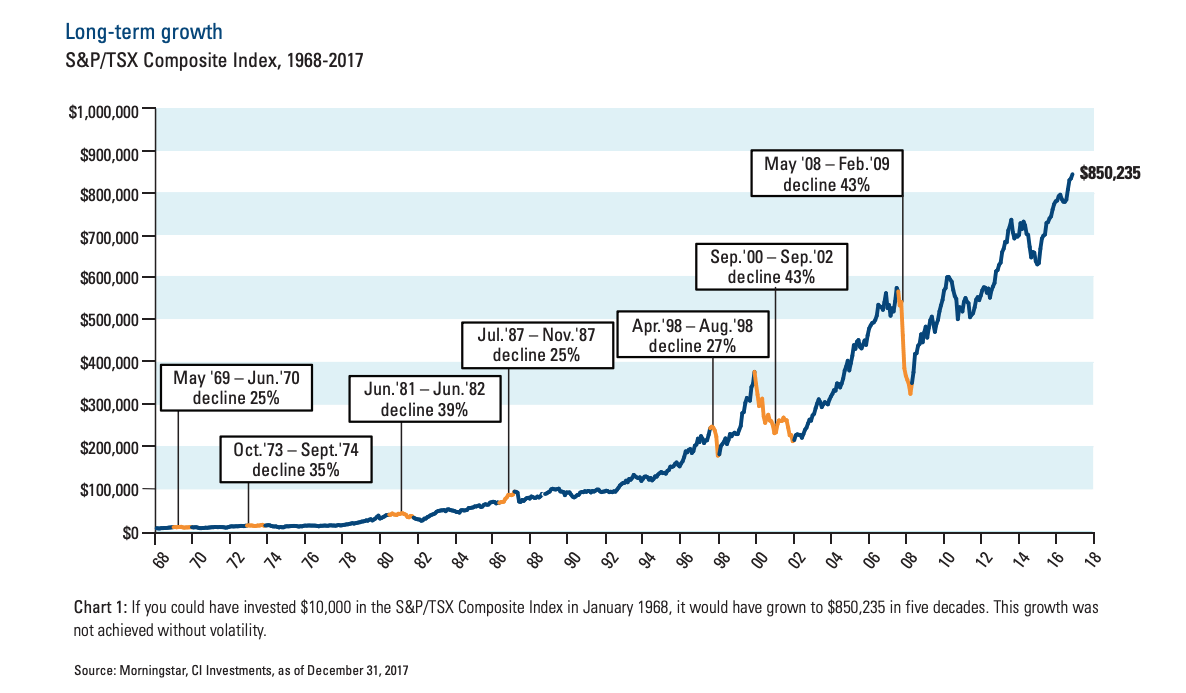

I have the benefit of insight of what the professionals share. That is why I redistribute their charts and comments for your benefit. When it comes to long term growth, look at the dips in the chart. Then look at the year after and the rise. There will be a significant dip for spring 2020 in next year’s chart. There will also be a considerable bounce back rise after. Markets are quite predictable on the bounce back, it happens every time.

Take a long-term view

If you also recognize the opportunity upon us and agree to start investing your cash while things are down, let’s meet soon to get organized. For those that need a bit more perspective about market volatility, this is my best piece of advice (and thanks to Tom T. for sharing):

Thank you for your trust in our team.

Best Regards,

Taivi Tayler, CDFA, RRC®,

Certified Financial Planner®

Taivi (pronounced Tie-V) Tayler, CDFA, RRC®, CLU, CERTIFIED FINANCIAL PLANNER® has been in the financial services industry for over 20 years. Her professional experience ranges from working for a trust company, the corporate head office of a Toronto based mutual fund firm, to association with independent wealth management firms.

She is currently affiliated with Financial Horizons Group and is a President’s Circle qualifying member:

Taivi holds the CERTIFIED FINANCIAL PLANNER® and CHARTERED LIFE UNDERWRITER® designations. These two complimentary designations represent the pinnacle of financial planning in Canada. Taivi specializes in tax efficient, tactical wealth management strategies for high income earners, business owners and professionals.

Goals based solutions presented to clients range from wealth creation and preservation to the transfer of assets to the next generation simply and effectively. Risk management and tax management are integrated strategies for all clients. Taivi requests to collaboratively work with her clients’ accountants, lawyers, therapists and mediators, as her belief is that these professionals and their services must be recognized and respected as the ultimate goal is to enhance every client’s overall wealth strategy.