Retirement Planning: Protecting Your Retirement in times of Volatility

The tsunami of change is here.

With the pandemic of 2020, so much that was is no more. Our lives have changed, our social circles have tightened, and we have all become excellent mask wearers (if not willing ones).

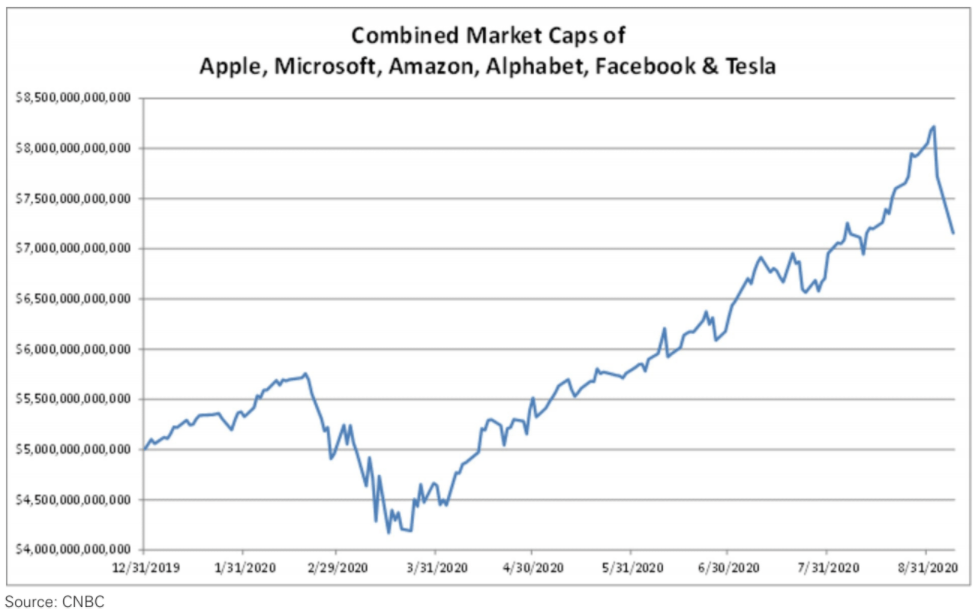

Over the summer, we witnessed the astronomical market return of a handful of stocks (Apple, Google, Amazon etc.), and then the subsequent price fall in late August/September.

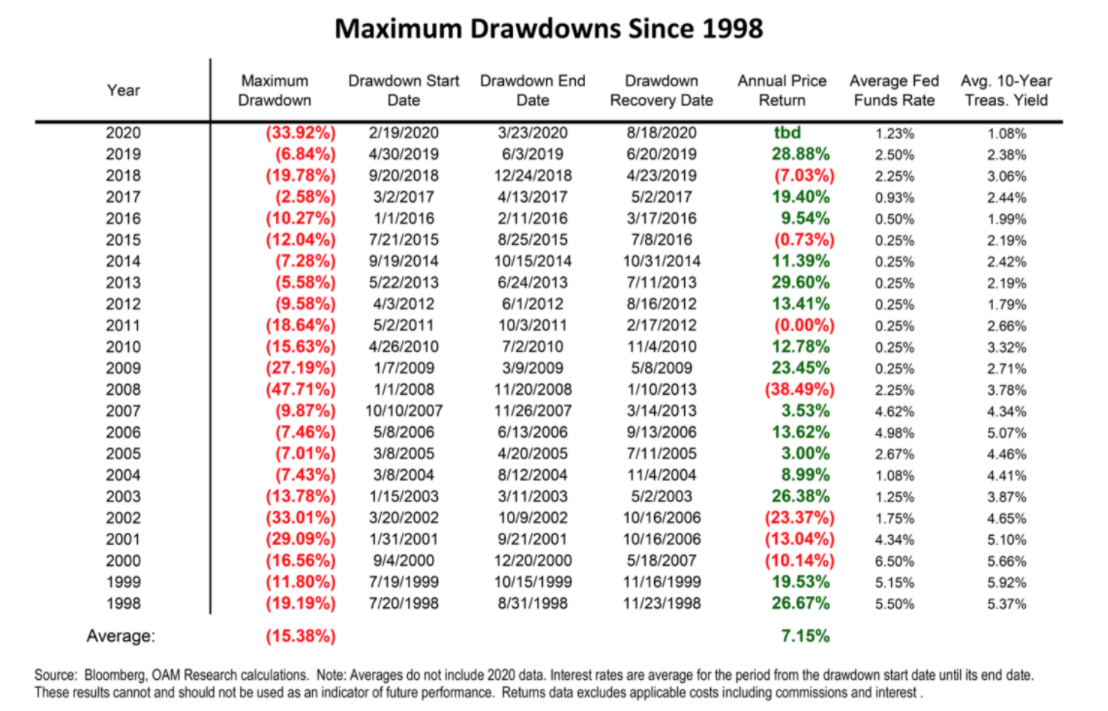

Every few years we get a serious draw down (Feb-Mar. 2020, Sept-Dec. 2018, May-Oct 2011, Jan-Nov. 2008) and those times embed themselves on our brains. The rest of the time, the stock indices are trading ever northward.

Time, patience, asset allocation, mental composure and long-term time horizons are all part of the tools in the toolbox while waiting out the volatility.

I like technology-based companies.

I also like Consumer Staples (think food companies) and Medical / Health Care companies (long before COVID19 this was a favourite of mine due to aging populations). Like any compatible relationship, investment funds and their internal stocks need to harmonize with each other, never compete.

It is important to build a portfolio structure that does not overlap and does not cause portfolio return friction. Those that entrust us with their wealth are familiar with my “spread the love around yet be concise” methodology.

If you have children, dying intestate (without a Will) can be horrifying, so it is critical that you name a physical guardian of your minor children in the event of your death. A financial guardian (who may or not be the same person as the physical guardian) is also required so that your wealth transitions to your children as per your instructions.

Finally, please consider their personalities, ages, and maturity level when writing these instructions. If you do not detail the age at which each child will receive their inheritance, it will all land in their lap at the age of 18. Sports car, anyone?

Insurance:

Insurance is often mistakenly viewed as an expense. Rather, it should be viewed as your “get out of crisis” free card.

Although we all consider ourselves invincible under the age of 40, the reality is that terrible things happen to awesome people. One may experience a work accident, become incapacitated and find themselves unable to work temporarily or perhaps never again. Life-threatening illnesses can also develop, disabling us or shortening our life expectancy. Strange accidents and tragedies occur in vehicles, on snowmobiles and on boats.

Our traditional way of living and interacting will continue to be challenged as our global society deals with a pandemic never seen in modern times. The markets are going to be choppy as global leaders and companies bring forth vaccines and pivot towards a slightly different future.

United States:

- On Wednesday, September 16, 2020 Federal Reserve Chair Jerome Powell and the Federal Reserve maintained interest rates at a near zero level. All signals are pointing to interest rates in the US staying low and being kept at that level until 2023. The expectation is that low interest rates will assist in the American economic recovery. Until inflation reaches a stable 2% amount, no change is to be expected.

- American’s said goodbye to Ruth Bader Ginsberg on Friday, September 18, 2020. The open spot on the American Supreme Court will be highly controversial over the coming weeks.

- The US Presidential Election Trump vs. Biden 2020. The media will report on accusations of mail in voter fraud. When the final verdict is announced, the markets will react (good or bad).

Canada:

- Tiff Macklem was appointed as the Governor of the Bank of Canada on June 3, 2020 for a 7year term.

- Bank of Canada interest rates are steady at 0.25 after dropping on March 27, 2020. This overnight rate is what financial institutions utilize to determine their interest rates for consumer loans, mortgages etc. Low rates are incentive to spend and borrow. Higher rates are used to lessen inflation. Ultimately the Bank of Canada wants to encourage positive economic activity striking a balance to keep inflation in check (avoiding high inflation or deflation).

- Canadians are paying down their debt. With our work life changing, our spending habits are changing as well. People are telecommuting to work. Less gas, less cost and wear / tear on vehicles. Working from home and not commuting means less money being spent on public transit. This rolls over to less lunches out and Starbucks coffee runs.

Those that became unemployed at the earlier part of the year received government response benefits that allowed them to adjust to circumstances changing beyond their control. As a result, individuals were able to accelerate paying down their credit cards and lines of credit. Outstanding debt dropped from a ratio of 158.2 % (April – June 2020) from 175.4 % (Jan- March 2020). (Source: https://www.cbc.ca/news/business/consumer-debt-statscan-1.5720402 )

However, the financial crunch could be on its way as government emergency benefits begin to wind up.

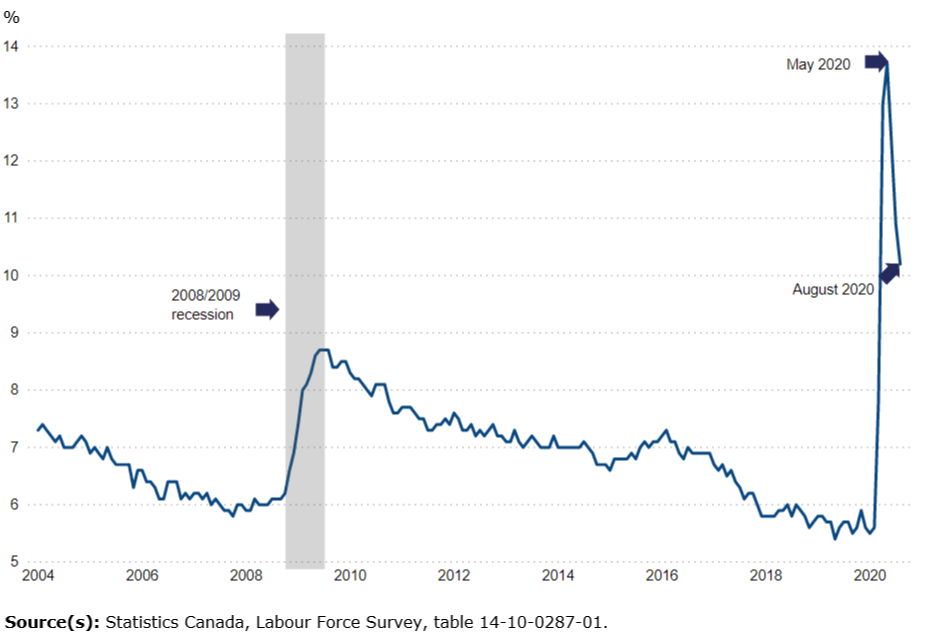

- In March 2020, at the beginning stages of the COVID19 pandemic, the unemployment rate in Canada went from 7.8% (which increased from 5.5% in February 2020) to 13.0% by April 2020, peaking at 13.7% in May, the highest number reached since record-keeping started in 1976.

(Source: https://www.ontario.ca/page/labour-market-report-february-2020; https://www150.statcan.gc.ca/n1/daily-quotidien/200409/dq200409a-eng.htm ; https://www150.statcan.gc.ca/n1/daily-quotidien/200605/dq200605a-eng.htm ; https://www150.statcan.gc.ca/n1/daily-quotidien/200508/dq200508a-eng.htm)

How does the above translate into our new COVID19 economy? Economists love to talk about rebounds as if they are shapes, their favourites being: “V”, “U”, “L”. It appears that the original rebound was a bit of a “V” in Canada / USA. Businesses learned to pivot.

Frances Donald of Manulife noted in a recent webinar we attended that Phase I Rapid Rebound ran from Mid-April to August and that 60-70% of the lost economic output came back.

We are currently in Phase II according to Donald. The Manulife team has deemed it the “Stall Out”. Businesses and the economy in general are trying to close that last 30% gap to get back to Pre-Covid19 output levels. The time frame: August 2020 – until 2022.

This position is backed up by Eric Lascelles of RBC Global Asset Management. He stated: “On balance, we believe the recovery can continue, albeit at a much slower rate than over the early going. To provide some perspective, developed economies reclaimed more than half of their lost economic output over the span of just three months. Recovering the other is likely to take the better part of two years.” (Source: MacroMemo-Sept15-Sept21, 2020)

Google mobility trackers are detailing loss of activity in retail and recreation of -12% on September 11, 2020. I wonder what that number will be a few months from now.

https://www.gstatic.com/covid19/mobility/2020-09-11_CA_Ontario_Mobility_Report_en.pdf

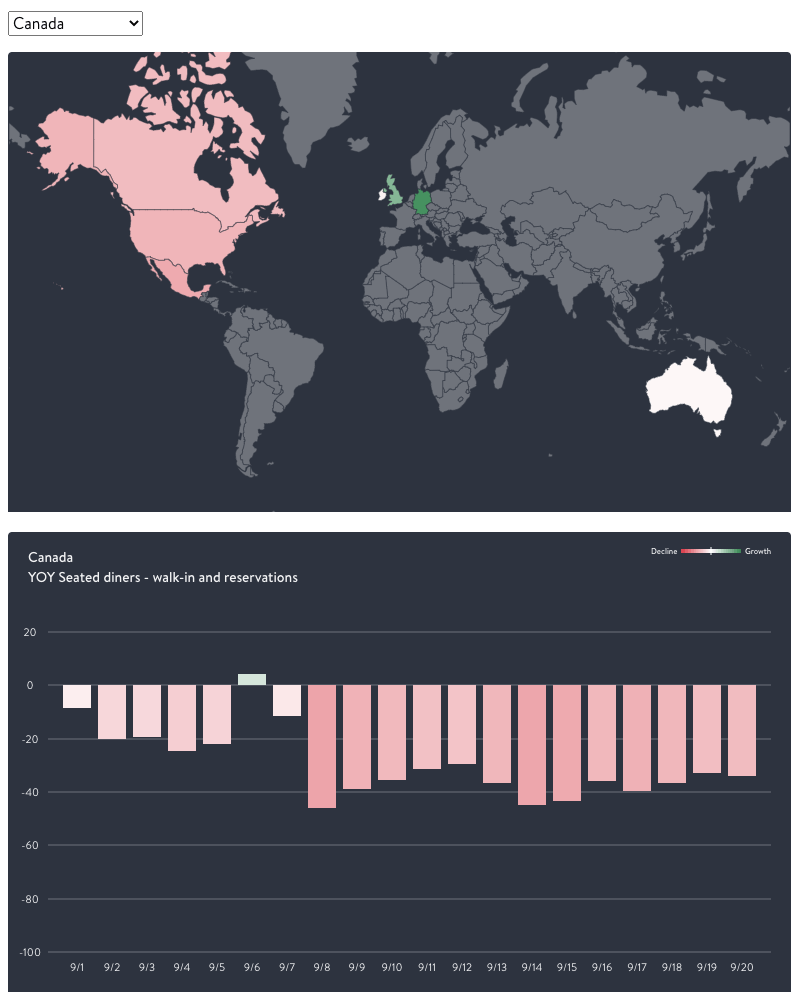

As mentioned in previous articles, we are in a services recession. Those that work in retail and restaurants may find that their employer closes shop when the cold sets in and winter is upon us.

Here is another data chart that economists are tracking, “dining in” restaurants. Lots of room in late August, busy on the long weekend, and much availability now.

When is Phase III the New Normal? Full economic recovery is hoped for 2022 onwards. Interest rates in Canada and the USA are expected to remain at zero or below zero (25% of global government bonds are negative yielding) for the next several years. As a result, investment managers must go to the equity markets or emerging market debt or infrastructure debt for yield.

For those that are politically minded, be aware, record high government debt is here (to stay). Running deficits, the new normal, globally. Economists have noted that governments are challenged in how to run their balance sheets post pandemic and that giving up the “balanced budget” mentality should be expected by all in the future.

How do you protect your portfolio? As mentioned at the beginning of this article: time, patience, asset allocation, mental composure and long-term time horizons are all part of the tools in the toolbox while waiting out the volatility.

Utilizing segregated fund contracts that put 100% investment maturity guarantees to protect your original investment capital or 100% death benefits in place can also provide peace of mind. Having the ability to lock in and reset your growth is also a unique tool in the financial toolbox that we can use strategically to build and maintain wealth.

All the best,

Taivi Tayler, CDFA, RRC®, CLU

Certified Financial Planner®

Sources:

- Eric Lascelles, RBC Global Asset Management MacroMemo Sept15-Sept21,2020

- Frances Donald Webinar Tuesday, Sept. 8,2020

- Phil D’Iorio, Cumberland Private Wealth, Market Update: Sept 11,2020

- Bloomberg, Fed reveals latest interest rate decision, Sept 16., 2020

- https://www.cbc.ca/news/business/consumer-debt-statscan-1.5720402

- https://www.ontario.ca/page/labour-market-report-february-2020; https://www150.statcan.gc.ca/n1/daily-quotidien/200409/dq200409a-eng.htm

- https://www150.statcan.gc.ca/n1/daily-quotidien/200605/dq200605a-eng.htm

- https://www150.statcan.gc.ca/n1/daily-quotidien/200508/dq200508a-eng.htm

- https://www150.statcan.gc.ca/n1/daily-quotidien/200904/g-a003-eng.htm

- https://www.gstatic.com/covid19/mobility/2020-09-11_CA_Ontario_Mobility_Report_en.pdf

- https://www.opentable.com/state-of-industry

- https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/

- https://www.bankofcanada.ca/2020/05/tiff-macklem-appointed-governor-bank-canada/#:~:text=The%20Directors%20of%20the%20Bank,Macklem%20will%20succeed%20Stephen%20S

Taivi (pronounced Tie-V) Tayler, CDFA, RRC®, CLU, CERTIFIED FINANCIAL PLANNER® has been in the financial services industry for over 20 years. Her professional experience ranges from working for a trust company, the corporate head office of a Toronto based mutual fund firm, to association with independent wealth management firms.

She is currently affiliated with Financial Horizons Group and is a President’s Circle qualifying member:

Taivi holds the CERTIFIED FINANCIAL PLANNER® and CHARTERED LIFE UNDERWRITER® designations. These two complimentary designations represent the pinnacle of financial planning in Canada. Taivi specializes in tax efficient, tactical wealth management strategies for high income earners, business owners and professionals.

Goals based solutions presented to clients range from wealth creation and preservation to the transfer of assets to the next generation simply and effectively. Risk management and tax management are integrated strategies for all clients. Taivi requests to collaboratively work with her clients’ accountants, lawyers, therapists and mediators, as her belief is that these professionals and their services must be recognized and respected as the ultimate goal is to enhance every client’s overall wealth strategy.